Are you concerned about share market turbulence? Property offers more than peace of mind and has long been regarded as a safe haven, providing lasting value, income stability, and resilience to changing conditions.

Recent market movements highlight just how reactive share markets can be. On 3 April, the Dow Jones plunged 1,679 points in response to the US government’s new tariffs – a 4% fall in a single day. The Australian share market followed suit on 7 April, recording its biggest one-day drop in five years and wiping nearly $100 billion off the ASX.

According to Ray White chief economist Nerida Conisbee, these sharp declines were driven by investor concerns over escalating trade tensions and the potential economic impact of the newly imposed tariffs. She then posed a rhetorical question: “Imagine if houses had a daily ticker price on them? It would cause widespread panic.”

Thankfully, they don’t. That’s one reason residential property continues to be viewed as a more stable, measured asset during periods of uncertainty.

Why does property weather storms better than shares

While share prices can drop sharply in a single day, property values tend to move more gradually. This gives investors time to make considered decisions, rather than reacting under pressure.

Property is also a tangible asset. Unlike shares on a screen, it meets a fundamental human need—shelter. People always need a place to live, and this underlying demand tends to remain steady, even during economic downturns or recessions.

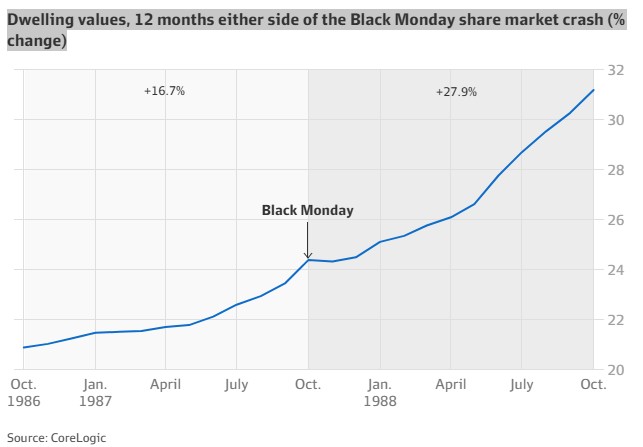

History supports this pattern. Following the 1987 Black Monday crash, property prices rebounded by 27.9% within 12 months.

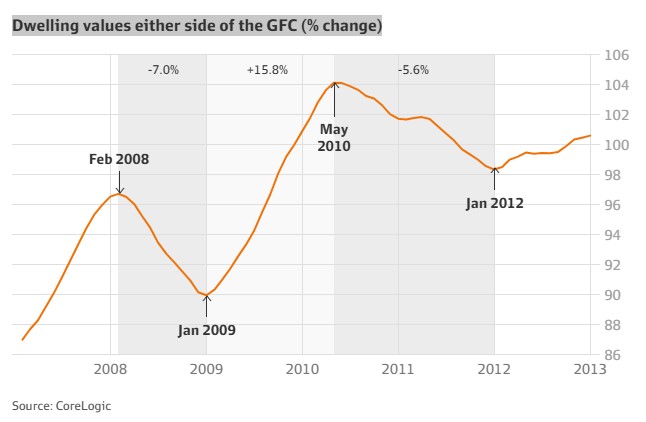

Similarly, after values dipped during the 2008 global financial crisis, they rose 15.8% in the following year.

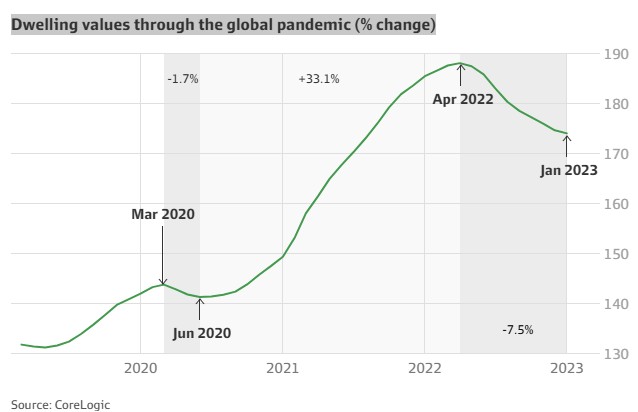

And during the early Covid-19 months, values briefly dropped before climbing 33.1% as interest rates fell and stimulus programs kicked in.

The bigger picture: more than just returns

Over the past five years, the ASX 200 has outperformed national property values in raw percentage terms, rising 71.4% from its March 2020 low. However, as PropTrack analyst Daniel Butkovich explains, this figure assumes perfect timing of buying at the exact bottom, which is rarely how share market investing plays out in reality.

“An investor who had bought in about a month earlier, when the market had just hit an all-time high, and held on through the crash and subsequent recovery would be looking at a return of just 8.6%.”

By contrast, in cities like Adelaide, Perth and Brisbane, property values have grown by more than 80% over a similar period, coming close to the ASX but with far less volatility.

Additionally, most property buyers make use of leverage. In other words, they borrow funds from a lender to purchase a home or investment property, typically covering around 80% of the value. This ability to borrow can amplify gains when values rise.

Mr Butkovich gives the following example: “If an investor bought a $500,000 property using a $100,000 deposit and a $400,000 loan, and that property rose in value by 46.7% (the same rate that the national median value grew), they would be sitting on a $233,500 gain, excluding any interest, expenses or rental income.”

On the other hand, he notes that leverage in the share market, also known as margin lending, is less common and has greater risks. Even small declines can result in significant losses, making margin lending a much riskier strategy.

Final thoughts

Economic turbulence may unsettle share markets, but residential property continues to demonstrate resilience and long-term stability. With interest rate cuts on the horizon, reduced borrowing costs could support renewed momentum, particularly in undersupplied areas where demand remains strong.

It’s also worth recognising that, beyond financial returns, one of property’s defining advantages is its practical value. A property offers shelter at its most basic level—but more than that, it is a physical asset that can be customised, renovated or rebuilt over time.

For many Australians, property represents more than an investment. It’s a home—a place of safety, stability, and security, which has become increasingly important in recent years during times of uncertainty. Explore our step-by-step guide to investing with clarity and confidence.

At SAFORE, we help clients turn uncertain times into strategic opportunities through education, clarity, and a long-term strategy tailored to their goals. With our unique combination of property, finance, and SMSF expertise, we don’t just find you a property—we empower our clients to build a future with confidence. If you’re ready to take the next step or simply want to explore what’s possible, we’re here to guide you with purpose and care. Contact us today on 1300 69 77 67 or click here.