Tax is more than an end-of-year chore for property investors — it’s a tool that can shape cash flow, boost after-tax returns, and guide smarter buying decisions that align with your long-term goals.

Too often, Australians step into the market without a clear tax strategy, missing legitimate deductions or overlooking straightforward opportunities to improve their results.

At SAFORE, we treat tax planning as part of your investment strategy from the very first step, not something left until June 30. Here’s what every investor should know to make informed, long-term decisions.

Four Key Taxes Every Property Investor Should Understand

Property investment involves several taxes, each applying at different stages — from the day you buy through to when you eventually sell. Knowing how they work helps you budget accurately, avoid surprises, and choose the right property and ownership structure for your goals:

- Stamp duty: A state-based tax paid upfront, usually within 30 days of settlement. The amount depends on the property’s price, location, and type. It’s one of the most significant initial costs, so it’s worth factoring in before you sign a contract.

- Land tax: An annual tax on investment properties (but not your home) based on the unimproved land value. Thresholds and rates vary by state, and owning multiple properties in the same jurisdiction can increase your liability.

- Rental income tax: Rent is taxable income, but allowable deductions can reduce what you owe. These can include loan interest, council and water rates, insurance, and property management fees. Newer properties can reduce the risk of costly repairs and also unlock substantial depreciation benefits, making the after-tax cost of ownership more efficient.

- Capital gains tax (CGT): Payable when you sell for more than you paid. Holding the property for over 12 months may qualify individuals for a 50% CGT discount. The timing of the sale can also affect when the tax is due, making planning important.

Understanding these four taxes is the foundation. The next step is knowing how to use them to your advantage — and that’s where strategic use of deductions, especially depreciation, can have a major impact over the life of the investment.

Deductions Done Right: Maximising Your After-Tax Return

Most investors know they can claim loan interest, but many miss out on thousands of dollars in additional deductions each year — often through poor record-keeping, the wrong ownership structure, or simply not knowing what’s available.

Common deductible expenses include:

- Loan interest and borrowing costs

- Property management fees

- Council and water rates

- Insurance

- Repairs and maintenance

- Advertising for tenants

- Depreciation on the building and fixtures

Depreciation can be a valuable non-cash deduction, helping to reduce taxable income and improve short-term cash flow. Newer properties may offer higher initial depreciation allowances, while also reducing the likelihood of significant repair costs in the early years.

However, it’s essential to plan with the long game in mind. Depreciation claimed today is added back when calculating your capital gain at sale, which can increase your CGT liability later. The right strategy weighs the cash flow benefits now against the potential tax impact in the future, ensuring your deductions work for you across the entire ownership period.

A professionally prepared depreciation schedule from a qualified quantity surveyor ensures you capture every eligible claim while building a clearer picture of the property’s long-term tax position. Thoughtful planning here can make a meaningful difference to your overall returns.

Four Factors That Shape Your Tax Outcome

Several decisions you make, both before and during ownership, can have a lasting impact on your tax position.

Timing of works

When you carry out repairs or upgrades, it affects how they’re treated. Replacing a broken oven after tenants move in is usually deductible in that year, while work completed before the first lease generally needs to be depreciated over time.

Ownership structure

You can buy in your own name, jointly with a partner, through a trust, via a company, or within a self-managed super fund (SMSF). Each option changes how income, losses, and future capital gains are taxed. An SMSF can be one of the more tax-efficient structures for long-term, retirement-focused investing, but it comes with strict rules and compliance requirements. The right choice can shape your cash flow, tax position, and flexibility for years, so it’s worth deciding with a clear strategy before you buy.

Planning ahead

Accurate records, an early depreciation schedule, and regular reviews with a tax professional help you capture every allowable deduction. Smart planning also considers the long-term effect, such as depreciation being added back when calculating CGT at sale. For many investors, the cash flow efficiency gained from depreciation during ownership can make it easier to afford and hold the property for longer. If the property grows in value over time, the deferred CGT impact may be outweighed by the benefits of long-term ownership and growth. Factoring this in from the start helps you plan for the future tax outcome, not just the annual cash flow benefit.

Property choice

Properties have different tax profiles. Some deliver stronger depreciation benefits that can improve cash flow early on, while others may have lower maintenance costs or a different balance of capital growth and holding expenses. Knowing how your chosen property will be taxed, and how it fits your overall plan, helps ensure it supports both short-term performance and long-term goals.

Negative Gearing: When It Works — and When It Doesn’t

Negative gearing happens when your rental income is less than your expenses — such as interest, repairs, and management fees. The shortfall (net rent loss) can be deducted from your other income, reducing your taxable income.

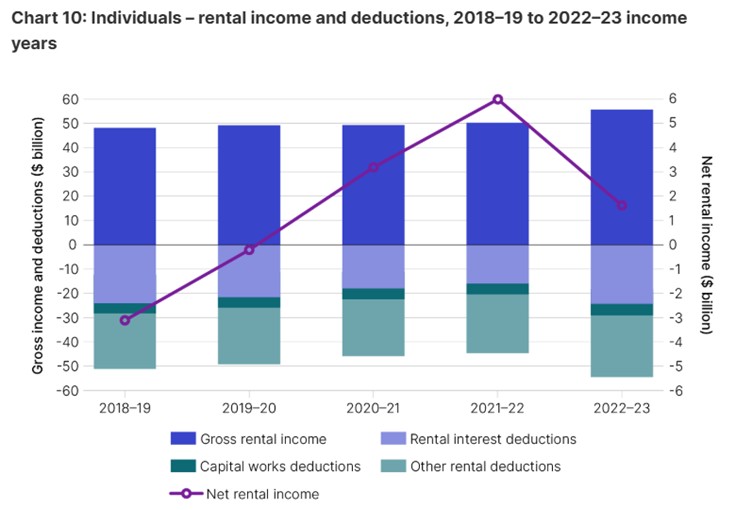

It’s a widely used strategy in Australia, but often misunderstood. According to the Australian Taxation Office (ATO), nearly half of all landlords reported rental losses in 2022–23, claiming a total of $10.4 billion in deductions — including $4.8 billion by those with two or more properties. While the tax benefit is real, the strategy only works in your favour if the property is expected to grow in value over time.

The chart below shows that in 2022–23, net rental income declined even though rental earnings held steady — highlighting how many investors were offsetting income with substantial deductions. While this can improve short-term cash flow through tax benefits, it also reinforces the need for a growth-focused property strategy to ensure the losses lead to long-term gains.

A tax deduction should never be the sole reason for buying. For example, if you earn $28,000 a year in rent but your expenses total $42,000, the $14,000 shortfall may reduce your tax bill — but it’s still cash leaving your account unless capital growth offsets it.

Negative gearing should be part of a broader investment plan that includes a well-chosen property in the right location, backed by thorough research and data-driven analysis. A clear growth strategy, combined with an understanding of your cash flow tolerance, is essential. Without the right property fundamentals, you’re simply making a loss.

CGT: Strategies to Plan Before You Sell

Capital gains tax (CGT) can take a substantial slice of your profit when you sell an investment property. Planning ahead can help manage the impact. Proven strategies to reduce CGT include:

- Hold for the discount – Owning the property for more than 12 months can qualify you for a 50% CGT discount, so only half the gain is taxed at your marginal rate.

- Use an SMSF effectively – CGT is often lower in an SMSF due to its concessional 15% tax rate. After 12 months, the one-third CGT discount reduces the taxable gain by 33.3%, resulting in an effective CGT rate of approximately 10% during the accumulation phase. In the pension phase, gains may be significantly reduced or even tax-free, depending on eligibility and transfer balance cap rules.

- Time your sale – Selling just after the end of the financial year can delay your CGT bill by up to 12 months, giving you time to prepare and manage cash flow.

- Track all improvements – Keep records of renovations, additions, and eligible acquisition costs. Adding these to your cost base at the time of sale reduces the taxable gain and can save thousands in tax.

For example, selling a property purchased for $800,000 for $1.3 million after six years results in a $500,000 gain, before factoring in any eligible costs that could be added to your cost base. If eligible for the 50% CGT discount, the taxable gain for an individual would be $250,000, with tax applied at their marginal rate. The calculation works differently for SMSF-owned properties, depending on whether the fund is in accumulation or pension phase, so qualified tax advice is essential.

You may also be eligible for specific exemptions. One example is the 6-year rule, which may allow you to treat a former home as your main residence for up to six years after moving out — potentially avoiding CGT entirely.

Why strategic advice matters more than ever

Australia’s property tax system is complex and constantly evolving. From negative gearing and CGT to SMSF rules and deductions, even small missteps can have lasting financial consequences.

That’s why it’s no longer enough to focus on the property alone. Strategic tax advice helps you choose the right ownership structure, capture every deduction you’re entitled to, and make smarter, data-driven investment decisions that align with your long-term goals.

Tax planning is part of investing

Tax isn’t just a cost — it’s a lever. Used strategically, it can improve after-tax returns, strengthen cash flow, and accelerate your path to wealth. But timing, structure, and compliance all matter. From how and when you buy, to the records you keep and the way you plan your exit, proactive tax planning can be the difference between an average result and an exceptional one.

Are you treating tax as part of your property strategy?

At SAFORE, we help investors turn tax insights into part of a bigger property strategy to strengthen cash flow, enhance portfolio performance, and drive long-term wealth. As property strategists, we focus on research, data-driven decisions, and residential markets to shape the right approach for each client.

Call us on 1300 69 77 67 or click here to learn how strategic property advice today can build lasting wealth tomorrow.

Disclaimer: This article provides general information only and does not constitute tax advice. You should consult a qualified tax professional to discuss your individual circumstances.