Australia’s residential property market is once again firmly in the sights of investors, with new data showing a sharp uptick in activity, signalling renewed confidence after a quieter couple of years.

According to the Australian Bureau of Statistics (ABS), the number of new investor loans rose 8.8% annually to 47,218 in the March quarter.

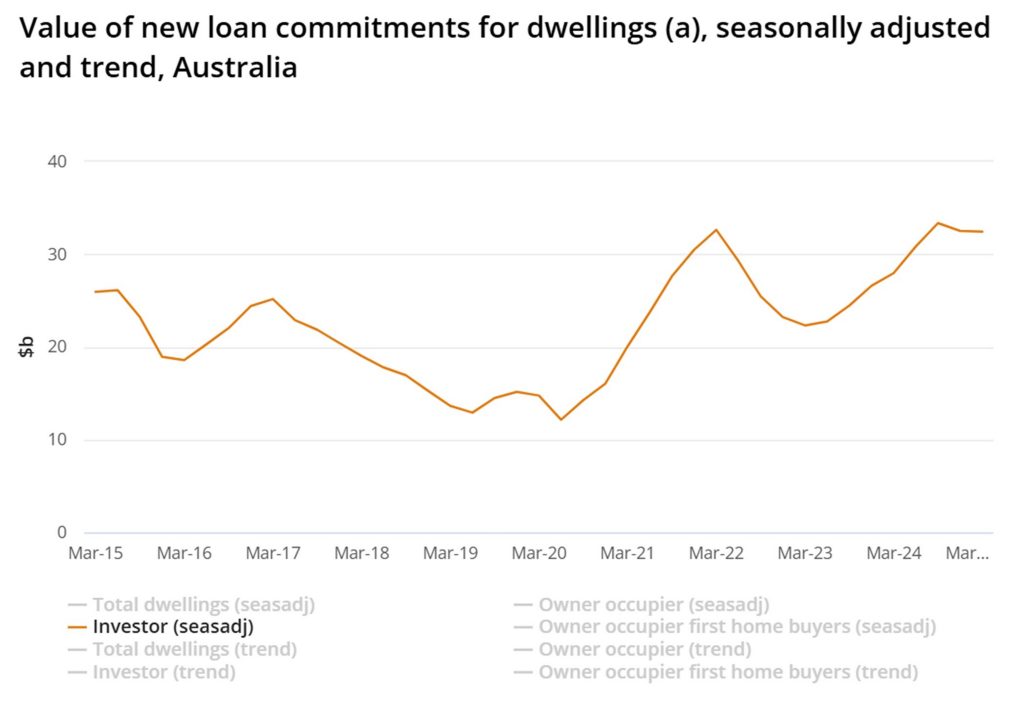

The value of these loans reached $32.4 billion – an increase of 16% compared to a year earlier.

The ABS data shows that the volume of new loans is currently close to highs not seen in nearly a decade. In fact, activity has been rising steadily over the past 18 months.

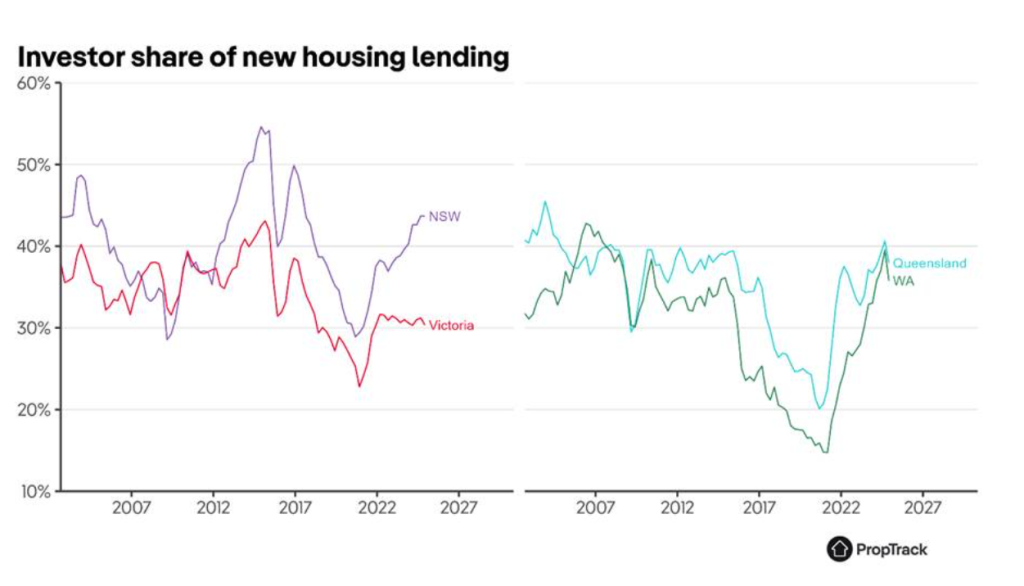

Investors are now accounting for one of the largest shares of new lending since 2017, a clear reversal from the quieter period following the initial interest rate rises in 2022.

Why investors are returning to property

Several interconnected factors are encouraging investors back into the property market, one of which is expectations of lower interest rates that are helping boost sentiment.

Although the Reserve Bank of Australia’s cash rate cuts have been modest to date, market expectations are for multiple cuts this year. If these materialise, they will not only lower borrowing costs for investors but are also likely to lift demand across the broader property market, potentially increasing competition and placing upward pressure on prices.

History shows property prices tend to move quickly once rates start falling, with Bank of Queensland chief economist Peter Munckton saying a 10% to 15% price rise over the next two years is a reasonable expectation – regardless of how many cuts the RBA ultimately delivers.

At the same time, ongoing share market volatility has underscored the appeal of property as a relatively stable investment. Global uncertainties are prompting many investors to shift their focus from equities towards real assets. Australian residential property, underpinned by consistent demand and a long history of performance, is once again being viewed as a reliable option for wealth creation.

Rental market conditions are also strengthening investor confidence. Low vacancy rates in many capital cities are creating competitive conditions that are supporting strong rental yields. Properties with dual-income potential and well-located units are offering attractive returns, helping investors manage borrowing costs and improve cash flow outcomes.

With lending conditions stabilising and rental demand remaining high, investors are increasingly viewing residential property as a reliable avenue for long-term wealth building.

Why strategic advice matters more than ever

With more investors entering the market, making the right property choices has become critical. After all, it’s not just about purchasing any property — it’s about selecting one that fits into a broader strategy for long-term wealth creation.

This is where working with a property investment strategist makes all the difference. At SAFORE, we take a holistic view, aligning property selection with your financial goals. Unlike many advisers who overlook new properties, we selectively source new builds that offer distinct advantages—such as lower maintenance risks, fewer repair costs, stronger tenant appeal, and greater depreciation benefits—helping reduce the cash flow needed to hold your asset.

Beyond property selection, our strategic approach draws on deep expertise in investment advice, finance structuring, and SMSF strategy. Supported by a trusted network of mortgage and financial planning professionals, we deliver tailored property strategies designed to support your immediate needs and long-term goals.

Whether you’re investing for the first time, expanding an existing portfolio, or managing wealth through an SMSF, the right guidance helps you make confident, well-informed decisions.

Investor activity is rising — and the competition for quality properties is heating up. In this environment, timing your move with the right strategy is crucial. At SAFORE, we take the guesswork out of property investment, helping you make smart, informed decisions that build real, lasting wealth. Call us on 1300 69 77 67 or click here to learn how strategic advice can give you an edge in today’s market.