When it comes to property investing, the biggest difference I see between investors who build lasting wealth and those who never quite reach their potential isn’t about chasing the latest hotspot or earning the highest income. It’s about mindset.

From working with hundreds of investors over the years, I’ve seen how often people get caught up in fear, overthinking, or trying to predict the market. Many jump in without a clear handle on their cash flow, their numbers, or even what they want their investment to achieve.

The truth is, property rewards clarity, patience, and strategy. Shift the way you think, and decisions become clearer, the process feels less overwhelming, and results compound over time.

Here are seven mindset shifts I believe every serious property investor must make.

1. Property is a long-term wealth vehicle, not a quick win

The investors who succeed don’t treat property as a get-rich-quick play. They understand that wealth is built by holding quality property for a long enough period for compounding growth to take effect, typically over 10 to 15 years.

Short-term headlines will constantly shift, but the long-term narrative is what truly matters. When you hold quality assets through cycles, the ups and downs even out and growth compounds.

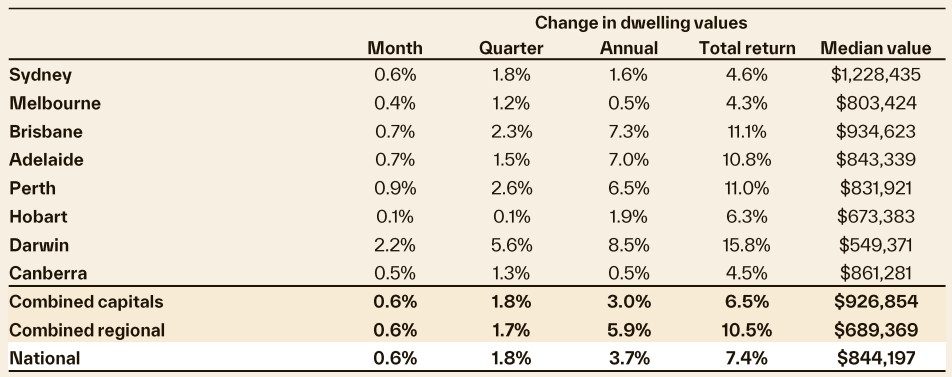

For example, Melbourne dwelling values rose just 0.5% in the 12 months to July, according to market data provider Cotality. Viewed in isolation, this might seem underwhelming.

However, the bigger picture tells a very different story. Over the past decade, property prices in Melbourne have risen by nearly 40%.

This highlights a crucial lesson: lasting wealth is created by holding quality property through cycles. Our role is to help clients align property decisions with their life stage, borrowing capacity, and cash flow. So they can invest with confidence and control, knowing that patience and strategy will drive long-term success.

2. Your strategy shapes the suburb, not the other way around

Too many investors start with a budget in mind or by looking close to home. The problem is, without a clear strategy, even what looks like a ‘good deal’ can quickly fall short.

Your ownership structure, tax position, borrowing capacity, and long-term objectives should be considered first. Once these are clear, it makes sense to set a budget, conduct your research, rely on the data, and start shortlisting locations.

We help clients reverse the usual thinking, starting with strategy and then shaping property choices to align with it. This ensures every purchase fits into a bigger financial plan, rather than being driven by price tags, postcodes, or guesswork.

3. Growth doesn’t happen by chance, fundamentals drive it

High-performing properties succeed when strong fundamentals back them. Think steady population growth, tight rental markets with low vacancy rates, and sustained infrastructure investment. There are always many factors at play, but these are the ones that create lasting demand over time.

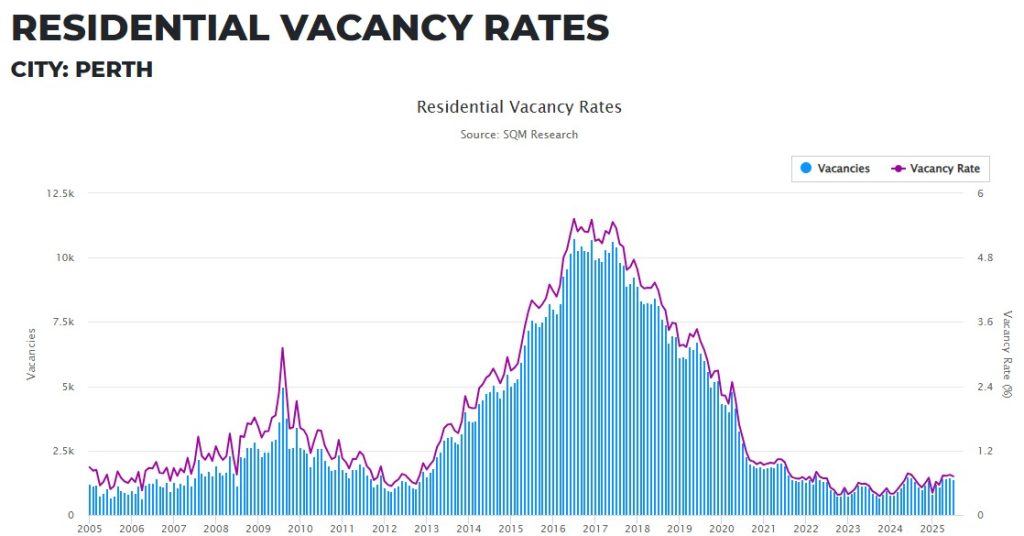

Take Perth, for example. According to the Australian Bureau of Statistics, Western Australia recorded the fastest population growth of any state in 2024, increasing by 2.4% year-on-year. At the same time, Perth’s rental market has stayed extremely tight, with vacancy rates below 1% for much of the past four years.

That strength shows why fundamentals matter – population growth, job creation, and infrastructure together fuel lasting demand. In the latest State of the States, Western Australia was ranked Australia’s top-performing economy for the fourth consecutive quarter, leading the nation in retail trade, housing finance, and business investment.

When jobs, spending, and infrastructure move in tandem, they attract more people and sustain housing demand, which ultimately drives property performance. That demand has flowed into Perth’s price growth, with dwelling values rising 6.5% in the 12 months to July, according to Cotality. Perth’s performance is not a matter of luck; it is the result of strong growth drivers working in tandem.

At SAFORE, we help clients cut through the headlines and focus on markets where multiple growth drivers work together like a cogwheel. This approach enables investors to identify opportunities with genuine long-term potential, rather than getting caught chasing short-term speculation.

4. Leverage is a tool when used strategically

Many investors view debt as something to be avoided. In reality, leverage is what allows property investors to unlock scale, accelerate growth, and compound wealth over time.

The difference between leverage as a risk and leverage as a wealth-builder comes down to strategy and resilience. When paired with strong buffers, income stability, and the right loan structures, debt can become a tool for growth – an enabler, not a stress point.

We guide clients in using leverage with confidence, helping them build portfolios that strike a balance between opportunity and protection. This approach means wealth compounds steadily without creating unnecessary stress.

5. Focus on time in the market, not market timing

Trying to “time the market” often leads to inaction. The truth is, no one can predict short-term movements with certainty. What matters most is how long you hold the asset and its quality.

Over the 20 years from 2005 to 2024, capital city house values rose by an average of 154%, while unit values increased 106%, according to the API’s Valuation Insights Report.

The journey wasn’t smooth. Prices dipped during the Global Financial Crisis in 2008–09, the post-GFC slowdown in 2011–12, and the APRA-driven credit tightening resulting from the Banking Royal Commission in 2018–19. Yet long-term holders still came out ahead.

But it’s not just time in the market that matters. It’s also the quality of what you hold. A well-located, high-demand property will recover faster from downturns and deliver more substantial returns over the long run than a property bought purely for price or speculation.

By contrast, investors who chased short-term mining town booms or oversupplied apartment markets often saw values fall when demand collapsed. A reminder that quality matters just as much as time in the market.

We encourage clients to act when their finance and strategy are aligned – not when the media suggests it’s the ‘right time.’ Strategic investors then hold quality assets through market cycles, capturing long-term growth without being swayed by short-term noise.

6. Property is a business decision, not an emotional one

An investment property is not your dream home. It is a financial asset, and it should be evaluated based on its performance, not personal taste.

Falling in love with a property because of its style, street appeal, or finishes can cloud judgment. Strategic investors separate emotion from decision-making and stay focused on the numbers that matter: demand, rental yield, vacancy rates and long-term growth potential.

When we work with clients, we remind them that every purchase must serve their broader strategy. By treating property as a business decision, rather than an emotional one, investors remain disciplined and build portfolios that perform over time.

7. Cash flow clarity is just as important as capital growth

Capital growth might be the headline goal, but it means little if you cannot comfortably hold the property along the way. Without clear visibility on cash flow, even the best growth story can become a burden.

Clarity starts with knowing your holding costs, loan structure, and tax position. It also means building buffers that protect you when circumstances change.

When we work with clients, we focus on properties they can hold with confidence, not just ones that promise growth. With cash flow clarity, investors can navigate the cycles and allow growth to compound, turning their portfolio into a sustainable wealth engine.

The right mindset builds lasting wealth

Mindset is what separates investors who stop at one property from those who go on to build lasting portfolios. By shifting your perspective and treating property as a long-term, strategic, and business-focused asset, you give yourself the best chance of success.

Are you ready to shift from property investor to wealth builder?

At SAFORE, we know mindset is the foundation of lasting success. That means moving beyond postcodes and headlines, and instead approaching every decision with clarity, patience, and long-term strategy. We guide investors to see property not just as a transaction, but as a pathway to wealth, freedom, and the confidence to create security and flexibility for life.

Call us on 1300 69 77 67 or click here to discover how adopting the right mindset and strategy today can set you up for lasting success tomorrow.