Residential property has long been a favoured asset class for Australian investors. What is increasingly notable, however, is the extent to which self-managed super funds (SMSFs) are embracing residential property as part of a deliberate, long-term wealth strategy, rather than as a speculative or short-term play.

According to the latest data from the Australian Taxation Office (ATO), the value of residential property held within SMSFs increased by 52% over the five years to September 2025. This growth reflects more than just rising property prices. It highlights a shift in how investors are thinking about property inside superannuation, and the importance of getting the strategy right.

Why residential property appeals to SMSF investors

For many SMSF trustees, residential property offers a combination of characteristics that align well with retirement-focused investing.

First, property is a tangible asset. Unlike shares or managed funds, residential property is easily understood. Investors can see and touch the asset, assess its condition, and directly influence outcomes through location choice, tenant selection and ongoing management. This tangibility is often cited as a reason property feels more predictable and controllable over long timeframes.

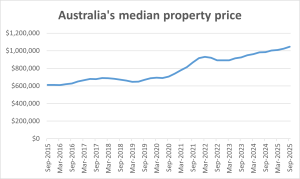

Second, while returns vary by location and cycle, residential property has a history of providing reliable income and long-term capital growth – over the decade to September 2025, the nation’s median property price rose 71.1%, according to the Australian Bureau of Statistics (see graph below). For SMSFs in accumulation or pre-retirement phases, this combination can support both income growth and balance stability over time.

Third, property is often perceived as insulated from short-term market volatility. Share markets can fluctuate sharply in response to economic data, interest rate expectations or global events. Residential property values tend to move more slowly, which can appeal to SMSF trustees seeking to reduce short-term volatility as retirement approaches.

Finally, residential property allows alignment with retirement timeframes. SMSFs are, by design, long-term vehicles. Residential property, when selected appropriately, can be held across decades, matching the investment horizon of superannuation far more closely than many short-term or tactical assets.

Why SMSF property requires a different strategic mindset

Despite its appeal, investing in residential property inside an SMSF is not the same as doing so outside super. This is where many investors underestimate the importance of strategy.

SMSF property involves long investment horizons with limited flexibility. Selling a property held in super is rarely quick or simple, particularly if market conditions are unfavourable. Restructuring debt, changing ownership or accessing capital is far more constrained than with personally held property. As a result, trustees must be confident that the asset will remain suitable across multiple market cycles.

There are strict regulatory rules that must be followed. SMSF residential property must meet the sole purpose test, cannot be lived in by members or related parties, and cannot be purchased from related parties. Borrowing must be structured through a limited-recourse borrowing arrangement, with conservative lending terms. These rules are clearly set out by the ATO and breaches can result in significant penalties.

Rental reliability and cost control matter more than headline returns. Unlike discretionary investments, SMSF property must fund its own expenses over time – including maintenance, insurance, property management and loan repayments. High-growth properties with weak rental yields or volatile costs can place unnecessary pressure on fund cash flow.

Liquidity planning is critical. SMSFs must meet ongoing expenses, tax obligations and, eventually, pension payments. A single illiquid asset can dominate a fund’s balance sheet, making it difficult to respond to unexpected costs or changes in member circumstances. Contributions, buffers and long-term cash flow planning must be considered well in advance.

Strategy over transactions

The growth in residential property holdings within SMSFs reflects increasing confidence in property as a long-term asset inside super. But it also highlights a risk: without a clear strategy, property can become a constraint rather than a solution.

Successful SMSF property investing is not about simply buying a good property. It requires:

- Alignment between the property and the fund’s retirement objectives

- Careful modelling of cash flow, contributions and expenses

- Realistic assumptions around growth and rental income

- Coordination between property strategy, lending structure and superannuation rules

This is where a holistic approach matters. Property should serve the broader wealth strategy – not dictate it.

Final thoughts

Residential property is playing a growing role inside SMSFs, as evidenced by the significant increase in holdings over recent years. For the right investor, it can offer stability, income and long-term growth that align well with retirement objectives.

But SMSF property is unforgiving of poor planning. The lack of flexibility, strict compliance rules and long time horizons mean that strategy matters more than ever.

SAFORE can help you assess whether SMSF property investing fits your broader wealth strategy and retirement objectives. Call us on 1300 69 77 67 or click here to book your strategy session to discuss your scenario.