Real wealth through property isn’t built overnight; it’s built through strategy, time, and consistency.

Experienced investors understand that success doesn’t come from chasing quick wins, but from making well-considered decisions that stand the test of time. They do the right groundwork early, follow a clear strategy, and allow time for their plan to take shape.

While short-term gains or speculative plays might tempt some, seasoned investors know that lasting returns come from a long-term approach, grounded in fundamentals and guided by patience.

Property is not a short-term game

Property prices in Australia tend to move in cycles. There are periods of growth, slowdown, correction and recovery. While short-term fluctuations can grab headlines, they often don’t reflect the broader picture.

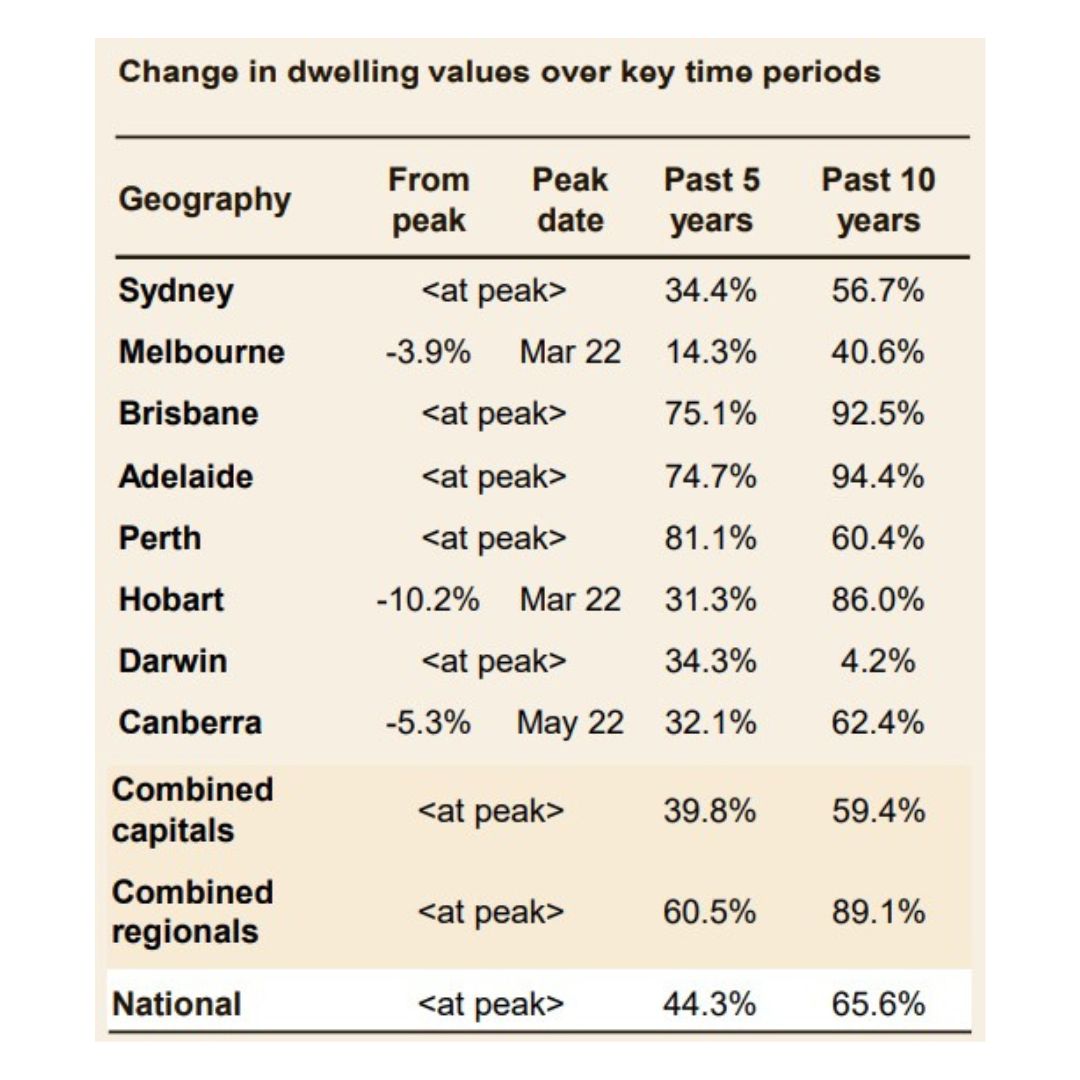

According to Cotality, national median house prices have increased significantly over the 10 years to June 2025, up 65.6%. That’s more than $330,000 gained on a median value property, even when accounting for downturns along the way.

A good example of this is Melbourne. Although its short-term performance has been slow, with median dwelling values having fallen 0.4% over the 12 months to June 2025, Melbourne’s long-term performance has remained strong. Dwelling values have risen 40.6% over the last 10 years.

An investor who bought in Melbourne recently may have questioned their decision as prices softened. But history shows that well-selected properties in desirable locations tend to deliver solid growth over time.

Longer hold periods tend to support stronger profit

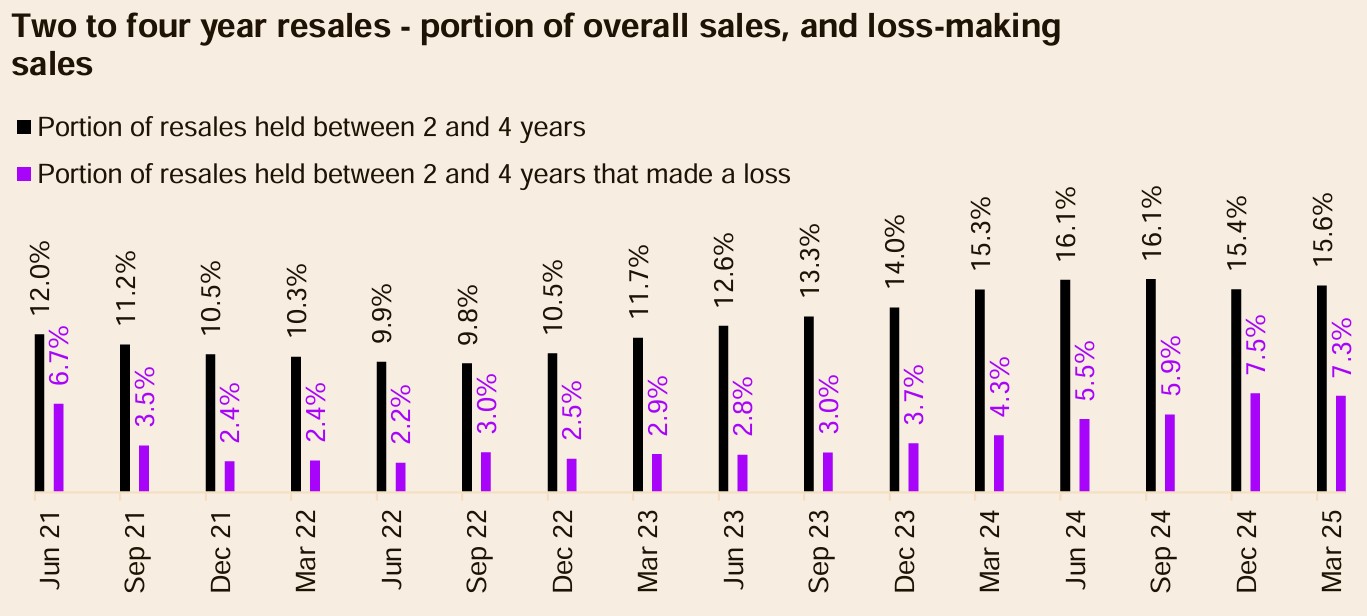

Data continues to support the notion that investment is a long-term game when it comes to profit-making. According to Cotality, in the March 2025 quarter, the national median hold period was 8.8 years, pointing to an average purchase date around mid-2016. Over that time, national home values have increased by 58.4%, supporting strong returns.

Short-term ownership, on the other hand, carries more risk. Properties resold after just two to four years in the March 2025 quarter saw a higher rate of loss-making sales (7.3%) compared to the national average of 5.1%.

Longer hold periods help investors ride out market cycles, avoid the pressure of forced sales during downturns and take advantage of compound growth. For anyone building a portfolio, the takeaway is simple: patience pays off.

The right property in the right location makes all the difference

Rather than trying to pick the perfect time to enter the market, successful investors focus on buying the right property in the right location with long-term prospects.

This means looking for areas with strong, long-term fundamentals, such as population growth, infrastructure investment, access to employment and lifestyle appeal. These are the factors that drive consistent demand and support capital growth over time.

But it’s not just about where you buy; it’s also about what you buy. Not all properties perform the same way, even within the same suburb. The type of property, its condition, and proximity to key amenities all play a role in how well it performs.

By making strategic choices, you can position yourself to benefit from both capital growth and reliable rental income, regardless of the property cycle’s fluctuations.

Why cash flow matters to long-term investors

Beyond capital growth, long-term property investment allows investors to benefit from consistent rental income. A property with strong rental returns can help cover holding costs and alleviate financial pressure, particularly during periods of high interest rates.

By taking a long-term approach, investors can manage cash flow more effectively and make decisions based on strategy rather than emotion. An investor with solid cash flow is less likely to panic during downturns or make rushed choices during boom periods.

Successful property investors get expert support

Successful property investors understand that markets move in cycles and that long-term results stem from making informed, strategic decisions, rather than reacting to short-term noise. The data shows that holding a well-selected property in the correct location over time significantly increases the likelihood of strong returns, both in capital growth and rental income.

But making the right decisions from the outset is critical. Expert support, from identifying the right asset to navigating changing conditions, can make all the difference to long-term outcomes. That’s where a strategic partner like SAFORE comes in. We help investors build wealth with clarity and confidence by focusing on quality, data-led decisions and long-term planning, not speculation.

Thinking beyond the next market cycle?

At SAFORE, we help investors build wealth with clarity and confidence by focusing on quality assets, strategy-first planning and data-driven decisions. Our approach is centred on patience and fundamentals, not speculation, allowing you to grow your portfolio with confidence across the property cycle.

Call us on 1300 69 77 67 or book a discovery call to see how a long-term strategy can position you for lasting success.